This post is part of the Growth University curriculum and has been condensed from the original video based format.

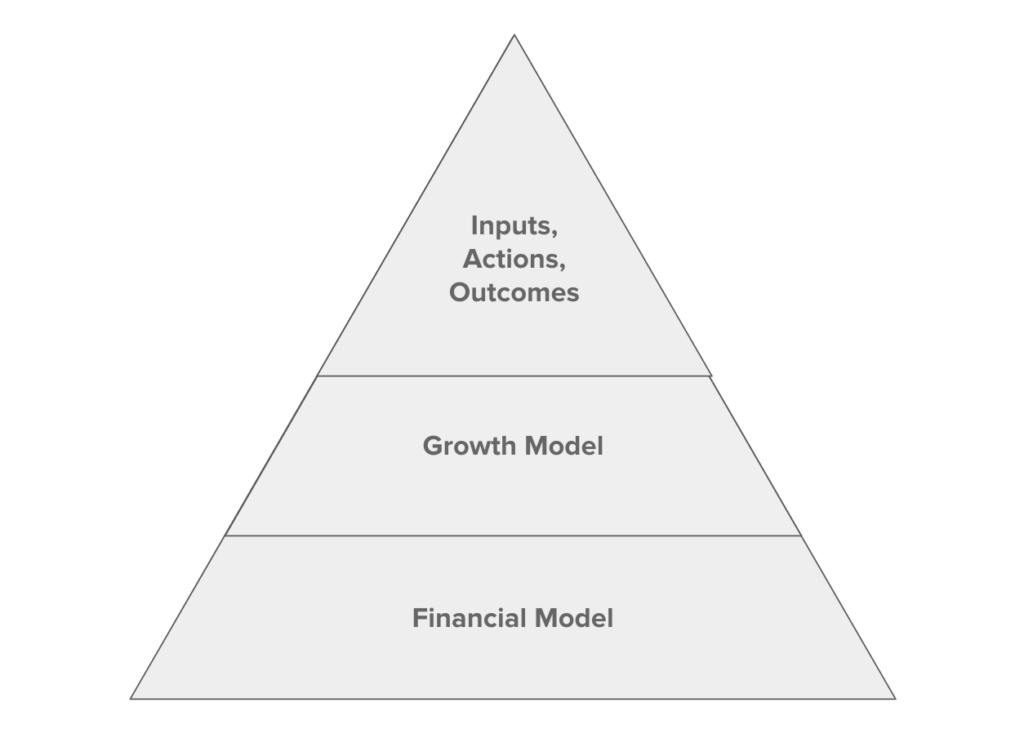

Core components of a growth framework

There are three main components to a growth framework. The focus of this post is on the foundational elements of your model – the financial model. In future posts we’ll get into the other models, but it’s critical that you understand your financial model before spending too much time on the other models.

A growth framework includes 3 main components:

- Financial Model

- Growth model

- Inputs, Actions, Outcomes

Each impacts the other, and there are multiple pathways through each component.

Financial model

The financial model enables us to quantify all growth efforts across the company. It’s the foundational level of our growth framework.

Growth model

The growth model expands the financial model by adding in budget, CAC & growth rate. You’ll look at this in week or month intervals.

Inputs, Actions, Outcomes (IAO)

Inputs drive actions which produce outcomes. This forms the basis of your day to day work across all areas of growth.

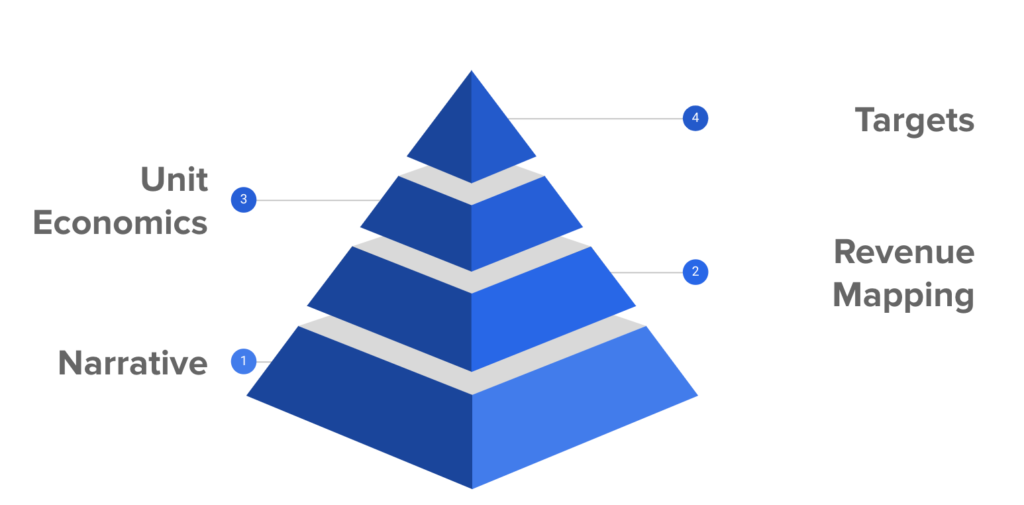

Building your financial model

Why do we build this first? The basis of your financial model is to provide an anchor by which to model your decisions off of. There are a few steps to this.

Every business needs revenue to survive. Here we will model the 4 components of the financial model:

- Building a narrative

- Revenue mapping

- Unit economics

- Targets

Step 1: Build your narrative

Your narrative is a simple statement that explains your company vision while encapsulating growth goals.

It should be aspirational – think about what great success would look like.

My narrative could be something like this:

Wild success for me would be reaching $10M in annual revenue in 5 years by building the most impactful Growth & Product training company in the world.

Growth Minded

A narrative has 3 components:

- A revenue goal

- A timeline

- A qualitative impact

For example, I may set the following narrative goals:

Revenue: $10M

Timeline: 5 years

Impact: Global leader in career development

Narrative importance

While not a replacement for something like an OKR or core company goal, your growth narrative will help align your company by:

- Forcing you to be explicit about revenue goals

- Setting a finite timeline to focus people on

- Having an aspirational long term goal around impact

Step 2: Run revenue mapping scenarios

Revenue mapping forces you to think about what getting to your end goal will take, and what the next couple of years may look like.

This enables you to model out different pathways to get there.

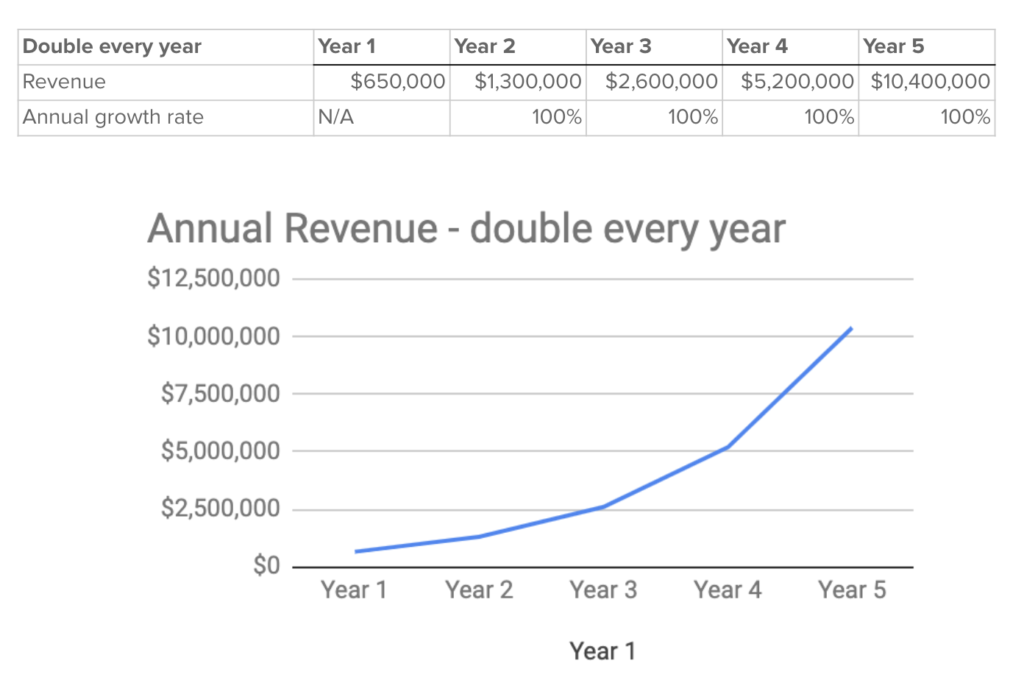

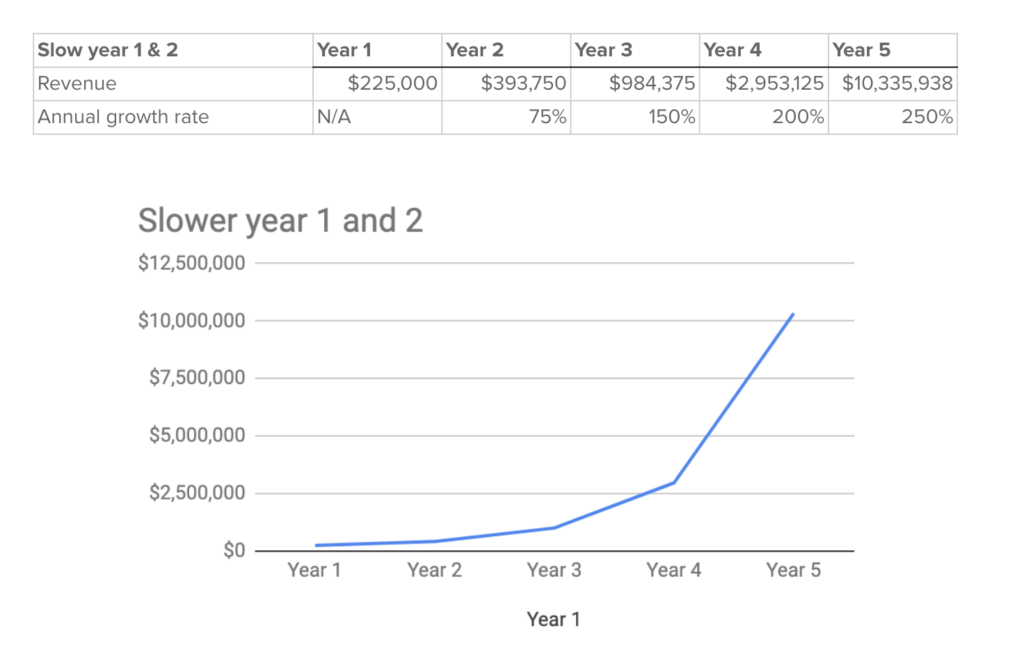

How do I get to $10M in 5 years?

To hit $10M in revenue in 5 years:

- If I hit $650k in year 1 and double revenue every year, I hit my goal in 5 years.

- If I do $225k in year 1 and have modest growth in year 2, I need to really accelerate.

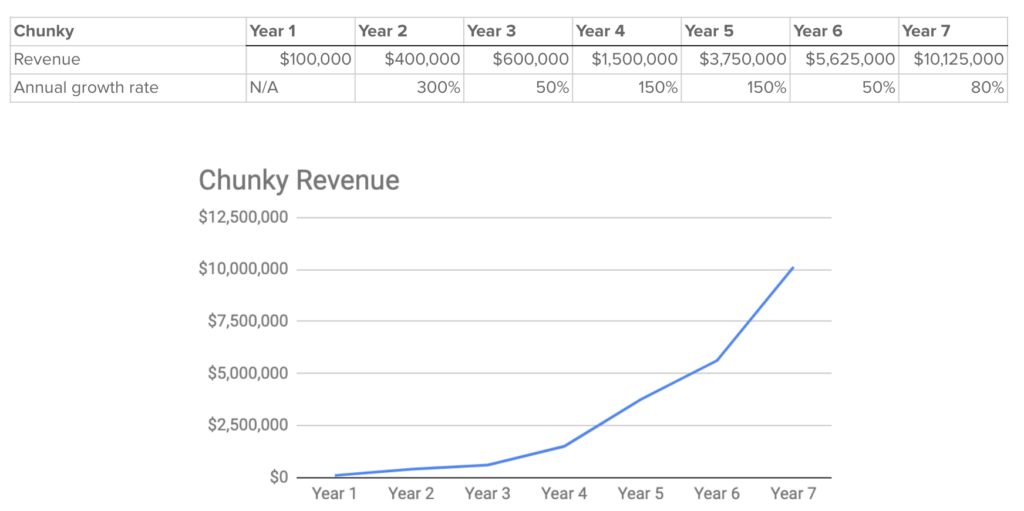

- If I have chunky revenue I need more time. My model shows 7 years.

Here’s what doubling every year looks like:

Here’s what a slower year 1 and 2 look like:

Here’s what chunky revenue look slike:

When modeling, balance slow vs rapid growth. Don’t be too aggressive, but don’t be too conservative. Your company culture and funding state will likely drive your thinking here. Don’t worry about perfection – you can update your model every month if needed, we’re building a baseline.

Would you like a copy of the data model? If so, fill out this quick form and I’ll email the sheet to you immediately.

Step 3: Work in unit economics

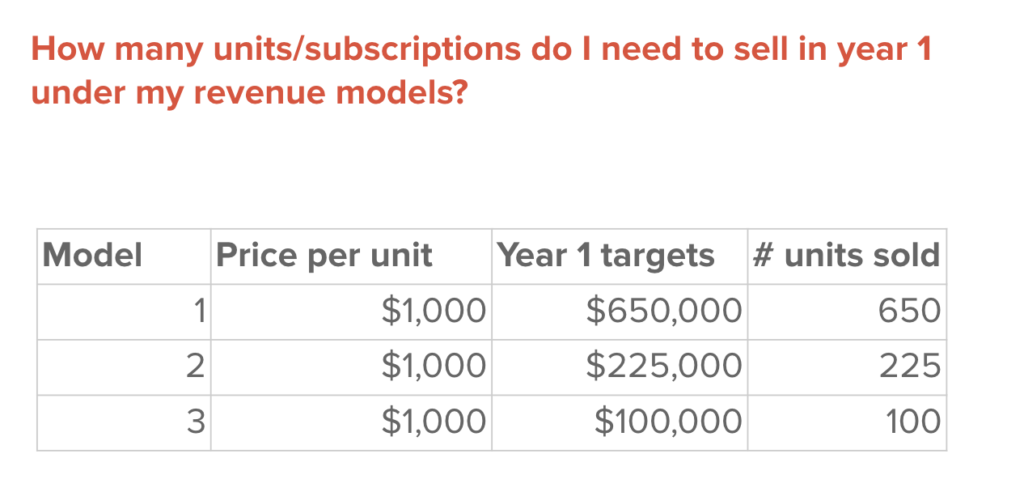

By looking at unit economics now, you can get a sense of how many units you need to sell, over time, to reach your goals.

Getting started – year 1 goals

My year 1 revenue is between $100k and $650k.

How do I get there?

What’s your main revenue model?

Transactional: people pay one or more times for something

Subscription: people pay once per X amount of time for something

Other: perhaps hourly or retainer based

What do you charge?

How much per unit do you charge?

- How much for a single purchase?

- How much for a subscription?

- What do you charge per hour/month?

Unit economics

Wow…that’s a lot of variance!

The difference between selling 100 and 650 units is huge!

Now you need to decide – what’s your year 1 target?

Step 4: Set your year 1 target

I’m going with something between my mid and high range model as it seems more realistic.

My target is $500k for year 1.

I need to sell 500 units to pull this off.

Choose a starting point

Initial model goal (transactional)

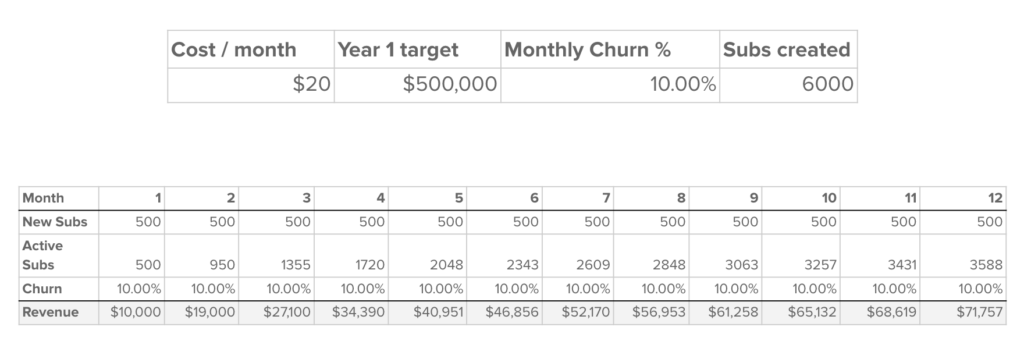

What about subscriptions?

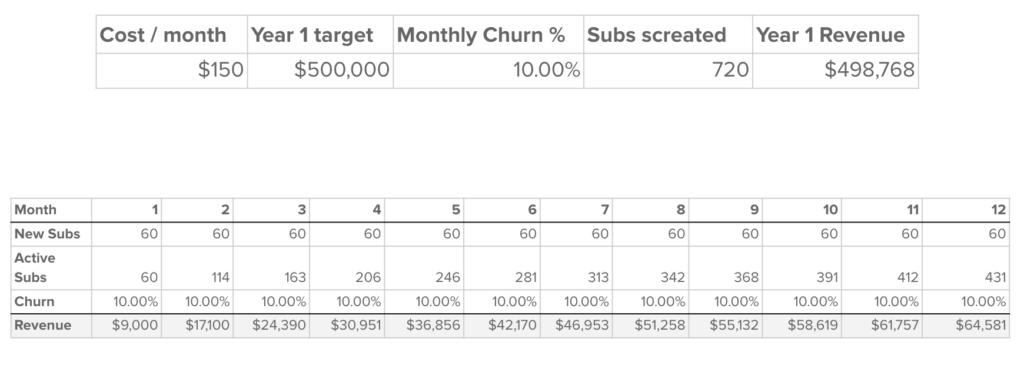

Subscriptions have a revenue goal, but you need to factor in monthly churn as a key metric as well.

Subscription components include:

- Cost per unit of time

- Number of new subscribers over that unit of time

- Number of total active subs

- Churn per unit of time

Sample $500k target with subscriptions (B2C)

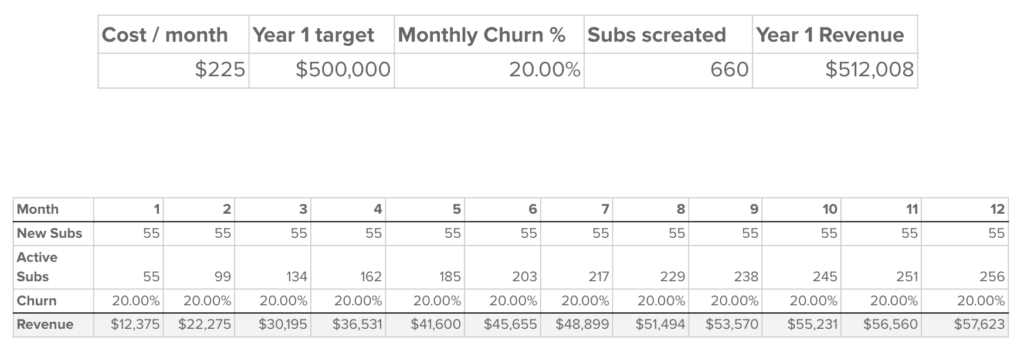

Subscription: $500k target, $225 product, 20% churn

Subscription: $500k target, $150 product, 10% churn

Study those charts above! Look at how churn destroys growth!

10% difference in monthly churn means a 33% lower cost product drives almost as much revenue with almost the same new subscriptions per month.

Like this post? You may be a great fit for Growth University. Check out more info here about the program, and become great at growth!

Would you like a copy of the data model? If so, fill out this quick form and I’ll email the sheet to you immediately.